Key headlines

- Core Spending Power will increase by £3.5bn (6.9 per cent in cash terms) nationally and £496m (6.7 per cent) across London boroughs.

- London boroughs will receive £243m (16 per cent) of the £1.5bn increase in grant funding for 2022-23 set out at SR21.

- The main council tax referendum principle will be 2 per cent and the Adult Social Care Precept will be 1 per cent for relevant authorities.

- Settlement Funding Assessment will increase by £75m (0.5 per cent) nationally, and by £17m for London boroughs

- A one off “Services Grant” worth £822m nationally (£152m across London) was confirmed.

- £162m to deliver adult social care funding reforms will be allocated in 2022-23 (London boroughs will receive £25m), with a further £600m in both 2023-24 and 2024-25 nationally

- The Social Care Grant will increase by £636m (37 per cent) to £2.3bn. London boroughs will receive £378m of this (an increase of 37 per cent)

- The Improved Better Care Fund will increase by 3 per cent (£36m nationally and £10m in London)

- Funding for New Home Bonus will decrease from £622m to £555m (11 per cent). London boroughs will receive £87m - a reduction of £38m (30 per cent).

- Business Rates Multiplier Compensation will increase by 58 per cent from £650m to £1bn nationally. London boroughs will receive £182m.

- Lower Tier Services Grant of £111m will continue (London boroughs’ will receive £25m)

- Allocations have not yet been published for the Public Health Grant, Homelessness Reduction Grant, Rough Sleeping Initiative Fund and the Independent Living Fund.

- The Government will work with the sector and consult in the coming months on reforms to measuring relative need and resources.

Core Spending Power

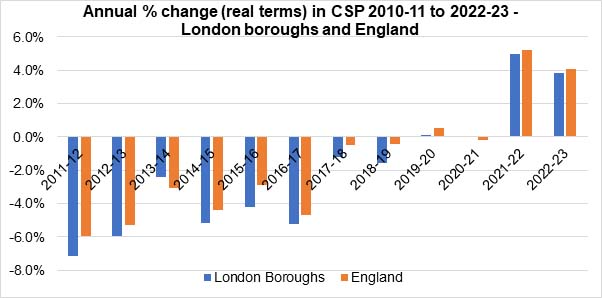

At the England level, Core Spending Power (CSP) will increase by to £3.5bn from £50.4bn to £53.9bn: a real terms increase of 4.1 per cent (a cash increase of 6.9 per cent). Across London boroughs, CSP will increase by £496m from £7.4bn to £7.9bn (3.9 per cent real terms and 6.7 per cent in cash values). This is the largest cash increase since 2010, and the second largest (after 2021-22) in real terms. Chart 1 below shows the real terms annual percentage change in CSP for London boroughs and England over that period. Despite this increase, CSP will remain 22 per cent below the 2010 level in real terms for London boroughs (16 per cent across England).

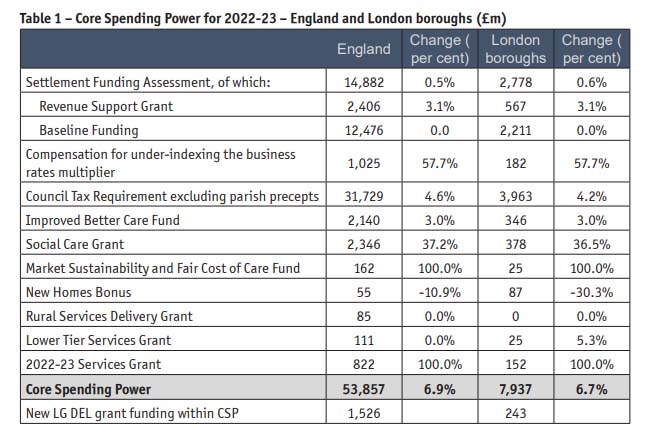

Table 1 below details the composition of CSP for London broughs and England overall. All existing funding streams within CSP will continue, with 2 new funding streams: the Market Sustainability and Fair Cost of Care Fund and 2022-23 Services Grant (see below for further details). London boroughs will receive £243m (16 per cent) of the £1.5bn of new grant funding announced at SR21. This is broadly in line with London’s share of the population.

Table 1 – Core Spending Power for 2022-23 – England and London boroughs (£m)

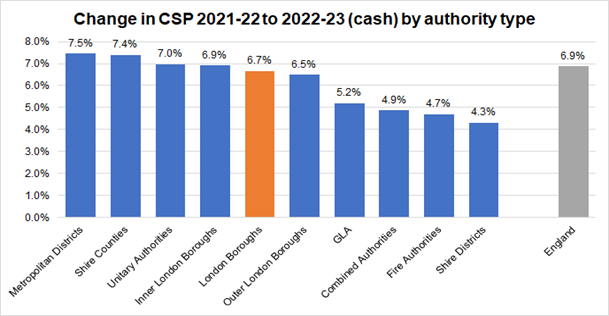

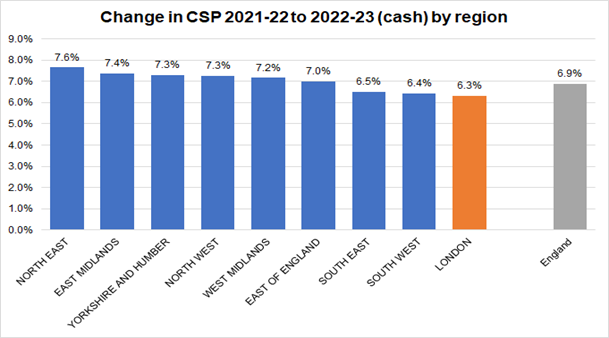

Charts 2 and 3 below show the change in CSP by authority type and region from 2021-22 to 2022-23. London boroughs will receive a lower increase than other unitary authorities with metropolitan districts receiving the largest increase at 7.5 per cent. The second chart shows London (boroughs and the GLA) will receive the lowest increase of any region.

Council Tax principles

The provisional settlement confirmed the intention for a core council tax referendum principle of up to 2 per cent in 2022-23. The flexibility to raise the Social Care Precept will decrease to 1 per cent for 2022-23 for relevant authorities. Those Local authorities that did not to take up the precept flexibility in full this year (2021-22) will still be allowed to defer up to 1 per cent for use in 2022-23. This means that London boroughs who set a 2 per cent increase for the precept in 2021-22, deferring 1 per cent to 2022-23, still have the additional 1 per cent flexibility in 2022-23.

The GLA charge for the Metropolitan Police will be allowed an increase of £10. The GLA will also have a core council tax referendum principle of up to 2 per cent. However, the consultation document notes that the Mayor of London is currently considering his approach to the future funding of Transport for London, and the Mayor is consulting on raising council tax by £20 a year to help fund TfL.

The Government estimates that if all London boroughs raised council tax by the maximum permitted overall council tax yield will increase by £160m to almost £4bn, and this figure is included within CSP.

2022-23 Services Grant

Almost half of the £1.5bn of new grant funding in 2022-23 will be distributed via a one off “Services Grant” worth £822m. The distribution will be determined by shares of 2013-14 SFA. London boroughs will receive £152m (18.5 per cent). The Government proposes that this grant will not be ringfenced.

Adult Social Care funding reform

SR21 set out £3.6bn of funding within CSP over the next three years to cover the costs of delivering the adult social care reforms. The PLGFS confirmed £162m for 2022-23 through the Market Sustainability and Fair Cost of Care Fund, which is intended to support local authorities prepare their markets for reform and move towards paying providers a fair cost of care. It will be allocated using the existing Adult Social Care Relative Needs Formula (RNF). London boroughs will receive £25m (15.5 per cent).

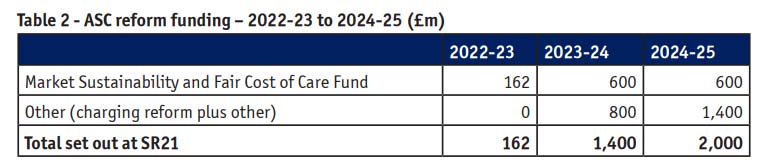

The Government will work with local government to determine appropriate grant conditions, national guidance and distribution mechanisms for funding allocations in 2023-24 and 2024-25, but has indicated that £600m will be allocated via this grant in those years. This leaves around £800m in 2023-24 and £1.4bn in 2024-25 to be allocated separately within CSP to cover the wider reforms to the cap and means test (see Table 2).

Baseline Funding

Overall, Settlement Funding Assessment (SFA) within CSP will increase by £72m (0.5 per cent) nationally and by £17m (0.6 per cent) across London boroughs. Within SFA, Baseline Funding (the target set by the Government for retained business rates) will remain flat at £12.5bn nationally and £2.2bn in London, following the decision in the Spending Review to freeze the business rates multiplier next year.

Business Rates multiplier compensation

Local authorities will be compensated for the shortfall in income for under-indexation of the business rates multiplier (including the freeze in 2022-23 and numerous past decisions since the start of the retention scheme in 2013-14 such as the switch in 2018-19 to CPI from RPI for the purposes of uprating. Top-ups and Tariffs will also be adjusted as in previous years, for the freezing of the multiplier. In total this compensation grant will increase by £350m to over £1bn across England. London boroughs will receive £182m (18 per cent).

Revenue Support Grant

Revenue Support Grant (RSG) will increase in line with September CPI inflation (3.1 per cent). To simplify the funding landscape, government intends to roll in the Electoral Registration grant, worth £1.2m per year, and the Financial Transparency of Local Authority Maintained Schools grant, worth £0.8m per year. The current distribution of each will no longer be used. Government intends to distribute this funding using the 2013-14 shares of SFA.

Negative RSG

The PLGFS confirmed that those authorities who would expect to receive “negative RSG” in 2022-23 will be compensated. Last year’s negative RSG figures for the three London boroughs who receive it (Bromley, Kingston and Richmond) will rise by CPI inflation. This funding technically sits outside of CSP.

Social Care Grant

Social Care Grant allocations will increase by £636m (accounting for around 40 per cent of the £1.5bn of new grant funding). SCG will total £2.3bn nationally, £556m of which will be allocated using the ASC RNF. A further £80m will be used to equalise the variation in yield from the ASC Precept. The grant remains un-ringfenced and it remains for authorities to determine how much should be spent on children’s social care. Overall, London Boroughs will receive £378m (16 per cent of the total): an increase of £101m (37 per cent) on 2021-22.

Improved Better Care Fund

The Improved Better Care Fund (iBCF) will be increased by £63m (3 per cent) and £10m in London. This will be an inflationary uplift on 2021-22 allocations in line with September CPI. The distribution formula remains unchanged, and the grant will continue to be required to be pooled as part of the Better Care Fund.

New Homes Bonus

The New Homes Bonus (NHB) will continue for a further round of payments in 2022-23 and, despite the Government consulting on reforms to the NHB earlier this year, the calculation methodology remains unchanged, with authorities needing to achieve tax base growth of greater than 0.4 per cent before they receive any NHB funding on new homes built. 2022-23 payments will be one off, so will not attract new legacy payments (as was the case in 2021-22). However, the Government is honouring previously announced legacy payments totalling £221m from the 2019-20 allocation.

Provisional NHB allocations therefore total £555m nationally (comprising the £221m for 2019-20 and £333m for 2022-23). Overall, this is a reduction of £68m (11 per cent) from 2021-22. London borough provisional allocations are £87m: a reduction of £38m (30 per cent). London boroughs’ share of the 2022-23 round has fallen to 13.5 per cent (from a previous average of around 20 per cent), reflecting a relative slowdown in housebuilding in the capital compared with the rest of the country.

Lower Tier Services Grant

The un-ringfenced Lower Tier Services Grant (introduced in 2021-22) will continue in 2022-23. The total will stay the same at £111m for authorities with responsibility for lower tier services. Overall, London boroughs will receive £25m (23 per cent): an increase of £1.3m.

Grants outside the settlement

Allocations of a number of other grants have yet to be published. These include:

- Public Health Grant (expected to rise by inflation as set out at SR21)

- Homelessness Reduction Grant (expected to be published w/c 20th December)

- Lead Local Flood Authorities Grant – which will be discontinued

- The Independent Living Fund – no decision made yet on continuation

- Local Council Tax Support Admin Subsidy and Housing Benefit Admin Subsidy will be confirmed later in 2022 (as usual)

Local Government Finance Reforms

Finally, the Government set out intentions to deliver an updated assessment of need and resources, through the Review Relative of Needs & Resources (previously referred to as the Fair Funding Review). The PLGFS confirmed the Government will work closely with the sector and other stakeholders over the coming months and consult on any potential changes to funding distribution, and that the one-off 2022-23 Services Grant will be excluded from any proposed baseline for transitional support.

Commentary

The 2022-23 provisional local government finance settlement provided much needed additional resources for London boroughs through the largest cash increase to Core Spending Power since 2010. Excluding, the funding to help deliver the “fair cost of care” element of the adult social care funding reforms, which will not address underlying demand pressures, the real terms increase to the remainder of CSP is 3.5 per cent (3.7 per cent across England). This delivers around £470m of extra funding to London boroughs next year.

While very welcome, the increase – 40 per cent of which comes through council tax (assuming all raise it by the maximum) and 60 per cent through grant funding – is unlikely to be sufficient to meet the significant challenges ahead.

Boroughs were already facing underlying demand pressures of £400m per annum excluding any impact of the pandemic (i.e. just to maintain services at the same level as before the pandemic hit in 2020-21). Clearly, they now face a much-changed environment due to the pandemic.

Firstly, there are substantial inflationary pressures. The increase of national insurance contributions (to fund health and social care) to London borough suppliers is estimated to be £40m next year, and there will be similar pressures on contracts from the rise in the National Living Wage and, more significantly, because of the soaring rate of general inflation, set to hit 6 per cent next year.

Secondly, Covid-19 has disproportionately hit London boroughs. Our estimates suggest that the legacy of uncompensated lost council tax and business rates income from 2020-21 and 2021-22 mean boroughs will have £300-400m less to spend next year (this alone exceeds London’s £243m share of the additional grant funding). The Plan B restrictions will mean further business rates and fees and charges income losses, and we have urged the Government to reinstate the SF&C compensation scheme that ended in July.

Thirdly, the rise in spending on key services - particularly adult social care, public health, homelessness & rough sleeping, and children’s social care - will continue into 2022-23. Boroughs experienced a £1.1bn rise in spending last year and were expecting £700m this year before the Omicron variant. The heightened pressures on these services are unlikely to end in March and will continue into next year.

So overall, a 3.5 per cent rise in CSP, while generous by historical standards, is unlikely to prevent boroughs from needing to make significant savings next year.

Turning to the detailed announcements in the settlement, the fact that more than half of the additional £1.5bn of funding was distributed as un-ringfenced grant is very welcome. As is the significant boost to Social Care Grant, given the huge pressures on adult and children’s social care resulting from the pandemic. It is also welcome that the distribution uses some level of equalisation for what can be raised through the social care precept, but disappointing it only uses the adult social care needs formula and not the children’s social care formula. Given the need for closer working between the NHS and social care, the inflationary 3 per cent increase to the iBCF is also disappointing.

While the overall reduction in New Homes Bonus was expected – as the legacy payments for 2018-19 year came to an end - the scale of the reduction in London boroughs’ 2022-23 allocation to just 13.5 per cent of the England total (when historically it has been around 20 per cent) suggests that housebuilding in the capital has slowed considerably and is evidence of the disproportionate impact of the pandemic on London’s economy. This is the third year the existing scheme has been rolled forward and a more permanent solution is required to provide longer term certainty.

The settlement was, once again, published on the last day of the Parliamentary term, leaving little time for councils to plan their finances for next year. The delay to publishing several other important grants – notably the Public Health Grant (PHG) and Homelessness Reduction Grants (worth around £820m to London boroughs this year) – further hampers financial planning.

The fact that PHG will only rise by inflation next year (confirmed at the SR) is very concerning given the pressures on the public health system, and so it was also disappointing that the Government didn’t take the opportunity provided by the settlement to extend the Contain Outbreak Management Fund to 2022-23, to give boroughs certainty about being able to support residents through the current wave of the pandemic.

Finally, the commitment to reforming the finance system is both welcome and overdue. The business rates retention system is desperately in need of a reset, as further evidenced by the fact that the government will be providing over £1bn of grant funding to compensate for historical government decisions, which have added unwelcome complexity and taken it further away from what it was supposed to be: a scheme to incentivise economic growth.

Most significantly, the commitment to updating the measurement of need and resources will now be a key focus of attention for the sector over the next 12 months. By April 2023, it will have been a decade since the funding formula has been updated. A decade in which London’s population grew by more than 1 million and when the gap between wages and housing costs grew starkly in many parts of London. The pandemic has further deepened inequalities and has hit London and other cities particularly hard. Ensuring the measurement of need is updated to reflect this will be a key priority for London Councils.

London Councils will respond to the PLGFS consultation by 13 January 2022 and make the case for additional resources ahead of the final settlement in February and work closely with member boroughs to influence the wider finance reforms next year to ensure a fair deal for Londoners.