1. Summary

This briefing sets out the financial pressures facing local authority Housing Revenue Accounts (HRAs) across London and reflects analysis produced by Savills (commissioned by the London Housing Directors’ Group) on the future sustainability of HRA finances. The analysis highlights deep challenges facing local authority HRAs – even if rents rise across London at the maximum permitted level, deep cuts in expenditure are forecast to be necessary and annual spending deficits are expected into 2044/45.

2. Background: Existing financial challenges for London HRAs

HRA self-financing was introduced by government in 2012, since then local authorities have been expected to balance HRA budgets according to rules set out by central government. The most relevant of these rules is the government defined policy on rent setting. At present official government policy sets out that social rents can rise by a maximum of inflation (measured by the Consumer Price Index, CPI) plus an additional 1% (CPI+1%). This policy is in place until 2025/26, and a government consultation on future rent policy is expected before then.

Despite self-financing, in five of the past seven years government has intervened to set policies well below inflation. Most recently, in 2023/24 the government imposed a 7% ceiling on rent increases. With CPI reaching 10-11% for much of the previous year, this cap has meant that costs have risen heavily above income. It is estimated that the cap will reduce investible income available to the London boroughs through rents by £598 million over the next five years (rising to £8 billion over forty years). The annual 1% rent reduction policy in place from 2016/17-2019/20 left rental income across London an estimated £459 million lower in 2021/22 than would otherwise have been expected. The COVID-19 pandemic has also reduced HRA resources by an estimated £100 million.

With inflation still running high for most of 2023, rent setting policy remains a vitally important issue in maintaining the long-term financial health for HRAs across London. To address this issue, further analysis has been commissioned.

3. Rising costs and rent setting for 2024/25

Recent conversations with the Department for Levelling Up, Homes and Communities (DLUHC) confirm that landlords will be able to raise rents in line with the existing CPI+1% rent setting formula in 2024/25 (i.e., there will be no below inflation rent ceiling implemented in the next financial year). With CPI in September 2023 [1] running at 6.7%, the maximum rent rise social housing providers, including local authority landlords, can enforce will be 7.7%.

However, analysis shows that inflation within the HRA cost base (for both capital and revenue) is highly likely to run well above CPI, with repairs and maintenance in particular experiencing continued cost inflation. Local authorities should expect to see these HRA cost increases continue to outpace CPI inflation for the next few years. It is important to note that these pressures are in addition to the impact of the 2023/24 7% rent cap.

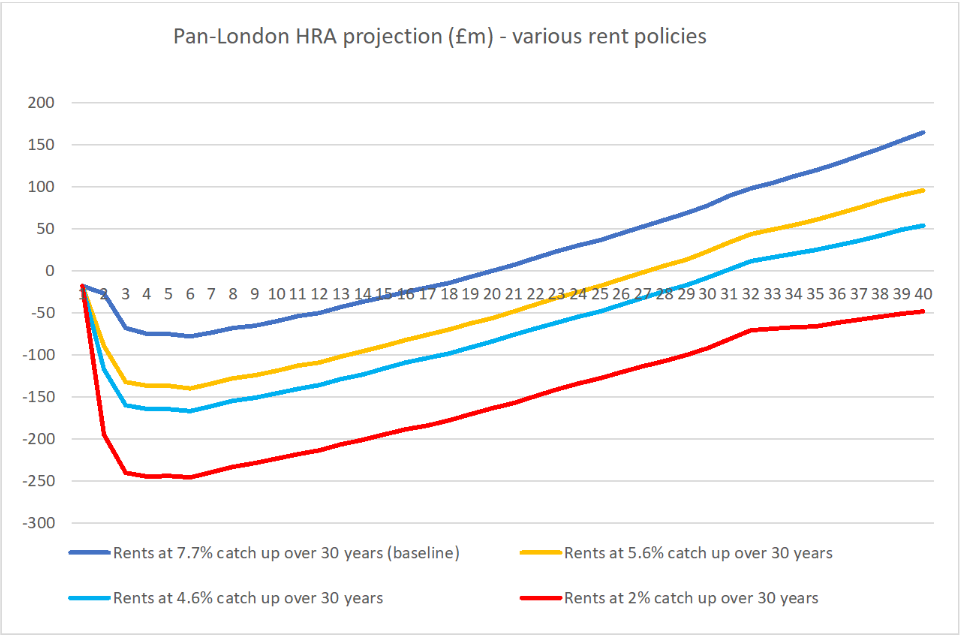

Savills’ analysis has projected the impact on a consolidated London HRA of this 2024/25 rent policy, drawing the following conclusions.

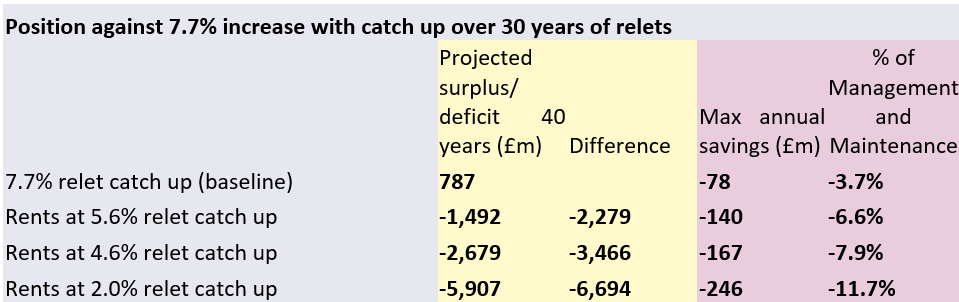

- Under a 7.7% rent increase (i.e. CPI+1%), London HRAs will remain in an annual budget deficit until 2044/45, with the largest amount of annual savings needed peaking in 2029/30 at £78 million – equivalent to 3.7% of management & maintenance cost savings requirement – this is what London HRAs are facing even in the ‘best case’ scenario.

- The cumulative impact over the first 20 years will be a loss of £888 million of income for London HRAs.

- Over a longer period of a 40-year business plan, HRAs are expected to end up in a budget surplus of £787 million, due to rents catching up with formula rent over the long-run as properties are re-let.

- The above scenario is assuming that local authorities pursue their maximum entitlement of a CPI+1% rent rise. In alternative scenarios, even just one year of a lower increase, has a significant cumulative impact on HRAs in the long run. The analysis estimates that every 1% that rents rise below the maximum permitted in 2024/25 (i.e., a 6.7% rent rise as opposed to 7.7%) would result in £1.1 billion less investable income over a 40-year period if replicated across all London HRAs.

- If rents increase across London based on the October CPI rate (4.6%), this would take £3.5 billion out of the cumulative 40-year HRA, requiring up to 8% annual savings in management and maintenance costs.

A full list of alternative scenarios, alongside a graphical representation of these scenarios, is presented in Appendix 1.

4. HRA cost pressures

The interaction between inflationary pressures and rent setting policy is one of several financial pressures on HRAs. Social housing providers are being asked to deliver a greater number of services and investments with lower funding available for delivery. Additional pressures include:

- Raising standards: London has the lowest social housing standards of any region nationally. In 2019-21 57% of all Housing Ombudsman maladministration cases for damp and mould were located in London, compared to 19% of the social housing stock. At the same time, the average satisfaction level among London council tenants is 19 percentage points lower than the national sector average. In total, £4 billion of investment is required to meet the Decent Homes Standard and EPC Band C in London, with analysis showing 43% of London’s social housing stock (c343,000 homes) is below one or both standards. Repairs and maintenance budgets have suffered inflationary pressures and many boroughs have set aside dedicated funding for tackling thorny issues such as damp and mould. Legal disrepair cases are also on the rise.

- Responding to legislative and regulatory challenges: The new proactive regulatory regime from the Regulator of Social Housing, as well as the expected improvements to the Decent Homes Standard (DHS), will increase the investment needed into existing stock. New professionalisation requirements will see 25,000 employees across the country need to take up further training or new qualifications without any sign of new burdens funding from the government.

- Viability challenges for new build: High construction cost inflation has rendered large swathes of new housing development unviable. New building safety requirements such as the need for a second staircase in buildings over 18m have put further pressures on these programmes. Around £37,000 extra per property could be needed in grant funding to bridge the current gap and allow these homes to go forward. However, investment in new council-led housing improves the sustainability of local authority finances (and the public sector more broadly) with access to social housing providing direct savings on temporary accommodation, homelessness and benefits budgets.

- Building and fire safety: The LGA estimates that £8.1bn is needed for all stock-owning local authorities to meet the highest building safety standards, including the installation of sprinklers and compartmentation.

- Decarbonisation: In 2021, analysis for London Councils estimated that retrofitting all homes in London to an average EPC B rating would cost £49bn, or almost £98bn if we are to hit Net Zero.

- Estate Regeneration: For many boroughs, outdated and obsolete stock means fighting an uphill battle against high repair and refurbishment costs. There is an increasing risk that these homes will fall into dangerously low standards. Wholesale regeneration is often brought forward to deal with this challenge, with the added opportunity of building more housing than was originally on a given site. However, insufficient funding for estate regeneration has hampered the ability of local authorities to take programmes forward while entrenching high ongoing maintenance costs.

5. London Councils’ policy asks

London Councils has been vocal in calling for additional investment to support HRA sustainability. Some key policy asks are outlined below:

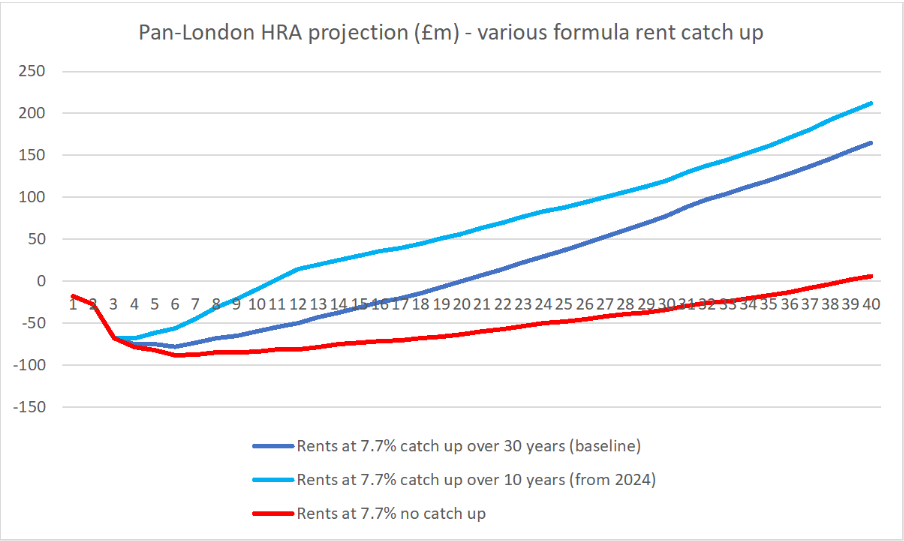

- A sustainable post-2025 rent settlement: With a new policy for rents due to be consulted on shortly, it is vital that the post-2025 settlement enables the sector to deliver on the growing number of unfunded priorities facing it. In particular, London Councils has called on government to enable a quicker catch up period on rents. Current provisions allow for properties to be re-let at ‘formula rents’, which Savills’ analysis assumes will mean that all properties will be re-let over a 30-year period. We are asking for a more favourable rent catch-up period, where rents are allowed to converge with formula rents over a 10-year period (i.e., without needing to be re-let.). As noted above, the baseline cumulative 40-year forecast is currently £787 million based on the current policy continuing into the future. With a 10-year formula rent convergence, this would improve to £2.52bn, an improvement of £1.7bn. It would also cut the number of years that London HRAs are in an annual revenue deficit in half, from 20 to 11 years. Appendix 2 shows the projection of these different rent policies. It is also vital the post-2025 rent provides certainty for the future, by setting out a long-term policy approach.

- A revised London HRA self-financing debt settlement: A number of government interventions have undermined the principles of the 2012 debt settlement. Savills’ new analysis provides an proposed new approach to updating this debt settlement, which would imply a reduction of 57% in HRA debt, down from £7.66 billion to £3.31 billion. This would enable additional borrowing power of £4.34 billion, potentially enough to cover all fire and building safety requirements as well as additional new build programmes. This adjustment is based on the following changes to DLUHC’s initial key assumptions.

- Rents policy changes, including 4 years of reduction and one year of a cap (£2.342bn)

- Increasing capital cost pressures - particularly in relation to fire/building safety and energy efficiency (£1.895bn)

- Property reductions due to "reinvigorated" Right to Buy (£0.107bn)

- Support for new housing delivery: Additional support for new build affordable housing would support the viability of development programmes and a reduction in HRA financial pressures. In particular, London Councils has called for improved grant funding via the Affordable Homes Programme, greater flexibility over the spending of Right to Buy receipts, and more certainty over funding for the sector (e.g. through guaranteed long-term funding settlements).

[1] the point at which CPI is measured to set the CPI+1% formula

Appendix 1

Appendix 2